UGRO Capital Announces Financial Results for the Quarter and Half Year Ended 30th September 2022

Mumbai, November 10, 2022: The Board of Directors of UGRO Capital Limited approved the financial results for the Quarter and Half year ended 30th September 2022 at its meeting held on Thursday, 10th November 2022.

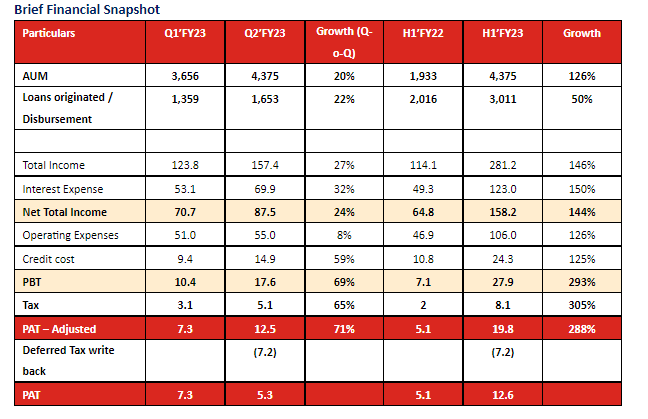

UGRO Capital, a DataTech NBFC and pioneer of LaaS in India continues its growth momentum in the second quarter of FY23 with AUM of INR 4,375 Cr (as on Sep’22), up 126% compared to Sep’21. The company reported Total Income of INR 157 Cr for Q2’23 (up 151% YoY and 27% QoQ) and INR 281 Cr for H1’23 (up 146% compared to H1’FY22).

U GRO Capital has effectively leveraged the co-lending partnerships with off-book AUM at 29%, up from 21% as of June 2022.

Commenting on the results, Mr. Shachindra Nath, Vice Chairman and Managing Director of U GRO Capital said, “U GRO Capital is revolutionizing MSME lending through its Data analytics prowess and robust technology architecture. We have been pioneers of Lending as a Service (LaaS) in India and have accelerated our expansion through co-lending and co-origination partnerships. Our increasing off book AUM of 29% demonstrates that our credit scoring model and underwriting framework are widely accepted across the banking industry. Our Q2 FY23 results with the highest ever disbursement demonstrate our unwavering commitment to growth. We continue to make progress towards the company’s core profitability on QoQ basis.

We achieved new milestones and scaled out our MSME Loans thanks to our persistent focus on our business strengths and extensive integration of data analytics in the decision-making process. With the proof of concept for GRO Score 2.0 established, we will soon launch GRO Score 3.0.”

Key performance highlights for Q2’ and H1’FY23

a)Growth, Expansion and Portfolio quality

- AUM of INR 4,375 Cr (up 126% YoY and 20% QoQ)

- INR 3,011 Cr of Gross Loans originated in H1’FY23 (up 168% compared to H1’FY22) and INR 1,653 Cr of Gross Loans originated in Q2’FY23 (up 110% YoY and 22% QoQ).

- Total Income stood at INR 158 Cr for Q2’FY23 (up 151 YoY and 27% QoQ) and INR 281.2 Cr for H1’FY23 (up 146% compared to H1’FY22)

- Net Total Income stood at INR 87.5 Cr for Q2’FY23 (up 144% YoY and 23.8% QoQ) and INR 158.2 Cr for H1’FY23 (up 144% compared H1’FY22)

- PBT increased to 17.6 Cr in Q2’FY23 (up 274% YoY and 69% QoQ) and 27.9 Cr in H1’FY23 (up 293% compared to H1’FY22)

- GNPA / NNPA as on Sep’22 stood at 1.7% /1.2% (as a % of Total AUM)

- Over 32,000 customers as on September 2022

- 98 branches (as on Sep’22)

b)Liability and Liquidity Position

- Total lender count increased to 67 as on September 2022, added 6 new lenders during Q2’FY23

- Total Debt stood at INR 2,725 Cr as on September 2022, and overall debt to equity ratio was 2.85x

- Healthy capital position with CRAR of 24.7% (as on September 2022)