Financial Results for the Quarter Ended 31st March 2022

Key Highlights

Business Performance in Key Parameters (as on 31.03.2022)

Global Business increased by 4.64 % on YoY basis to ₹1931322 Crore as at the end of March’22

as against ₹1845739 Crore in March’21.

Global Deposits grew by 3.61% on YoY basis to ₹1146218 Crore as at the end of March’22 as

against ₹1106332 Crore in March’21.

Global Advances grew by 6.18 % on YoY basis to ₹785104 Crore as at the end of March’22 as

against ₹739407 Crore in March’21.

In Retail Segment,

o Housing loan increased by 3.6 % on YoY basis to ₹73805 Crore.

o Vehicle loan increased by 23.4 % on YoY basis to ₹12615 Crore.

o Personal loan grew by 14.1 % on YoY basis to ₹12193 Crore.

Priority Sector

Priority Sector Advances stood at ₹283712 Crore, exceeding the National Goal of 40 % and was at 42.42 % of ANBC as at the end of March’22.

Agriculture advances stood at ₹122708 Crore, exceeding the National Goal of 18 % and was at 18.35 % of ANBC as at the end of March’22.

Credit to Small and Marginal farmers stood at ₹65979 Crore in March’22. National Goal achievement is 9.87 % of ANBC, exceeding the target of 9 %.

Credit to Weaker Sections stood at ₹90002 Crore in March’22. National Goal achievement is 13.46 % of ANBC, exceeding the target of 11 %.

Credit to Micro Enterprises stood at ₹53963 Crore as on March’22. The Bank has achieved National Goal at 8.07 % of ANBC as against the target of 7.5 %.

Profitability

Total Income of the Bank for FY’22 was at ₹87200 Crore.

Operating Income of the Bank for FY’22 was at ₹41014 Crore.

Total Interest Income of the Bank for FY’22 was at ₹74880 Crore.

Net Interest income grew by 5% in Q4FY22 to ₹7304 Crore from ₹6957 Crore.

Total Expenditure of the Bank for FY’22 declined by 6 % to ₹66438 Crore.

Operating Expenses declined by 11% for Q4FY’22.

Total interest Paid registered decline of 4 % on QoQ basis to ₹11341 Crore in Q4 FY’22 from ₹11852 Crore in Q4 FY’21.

Efficiency Ratio

Cost to income ratio for Q4 FY’22 improved by 690 bps to 46.02 % in Q4FY’22 from 52.92 % in Q4FY’21.

Global Cost of Deposits improved to 3.90 % in Q4 FY’22 from 4.22 % in Q4 FY’21.

Return on Assets improved to 0.26 % in FY’22 from 0.15 % in FY’21.

Yield on Advances at 6.64 % in Q4 FY’22. Yield on Investment at 6.41 % in Q4 FY’22.

Business per employee improved to ₹1941 lacs in March’22 from ₹1885 lacs in March’21.

Financial Inclusion

Asset Quality

Gross Non-Performing Assets (GNPA) stood at ₹92448 Crore as on March’22 as against ₹104423 Crore as on March’21 declined by 11.47 %

Net Non-Performing Assets (NNPA) stood at ₹34909 Crore as on March’22 as against ₹38576 Crore in as on March’21 declined by 9.51 %.

Capital Adequacy

CRAR improved to 14.50 % in March’22 from 14.32 % as at March’21. Tier-I is 11.73 % (CET-1 was at 10.56 %, AT1 was at 1.17 %) and Tier-II CRAR is 2.77 % as at March’22.

Digitalization

Internet Banking Services (IBS) users increased to 340.29 Lakhs as at March’22.

Mobile Banking Services (MBS) users increased 69 % YoY to 337.73 Lakhs as at March’22 from 199.76 Lakhs in March’21.

Number of Debit Card issued is 7.61 Crore as on March’22 with 71.33 % Debit Card penetration of eligible base.

UPI transactions increased by 81% to 200 Crore as at March’22

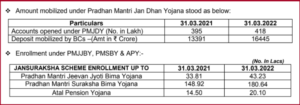

Amount mobilized under Pradhan Mantri Jan Dhan Yojana stood as below:

New Initiatives – FY 21-22

PNB 360 – a comprehensive dashboard to monitor business performance

Collection of Loan EMI through BBPS – repaying loan EMI through Bharat Bill Pay System

Trade Finance Redefined Portal – facilitates customers to initiate forex trade transaction online

Digitalization of Recovery Process for optimization of TAT

ASBA on PNB ONE – facilitate investors for subscribing to IPO 24*7

Insta Personal Loan to Pensioners

Card-less Cash Withdrawal – allows cash withdrawal facility from PNB ATMs without debit card PNB Virtual Debit Card – eliminates need of carrying physical Debit Card.

PNB ECOLENS – a monthly bulletin covering economic and banking indicators

Awards & Accolades

Most Significant Lender Supporting SC Entrepreneurs’ by Ministry of Social Justice & Empowerment.

Best MSME Bank (PSU) in 8th MSME Excellence Awards for FY’21 by ASSOCHAM.

Best Data Quality Improvement Award on Commercial Bureau for FY’21 amongst Public sector Banks by TransUnion CIBIL.

Jointly with M/s Infosys won the “Global Banking & Finance Awards 2021” in the category “Initiative Core Amalgamation” for FY’21 by Global Finance Review Company.

Secured 1st position amongst peer banks under Agriculture Infrastructure Fund (AIF) campaign launched by Ministry of Agriculture and Farmers Welfare.

Award of Excellence in Campaign APY Leadership Capital launched by PFRDA during 3rd January to 17 February 2022.