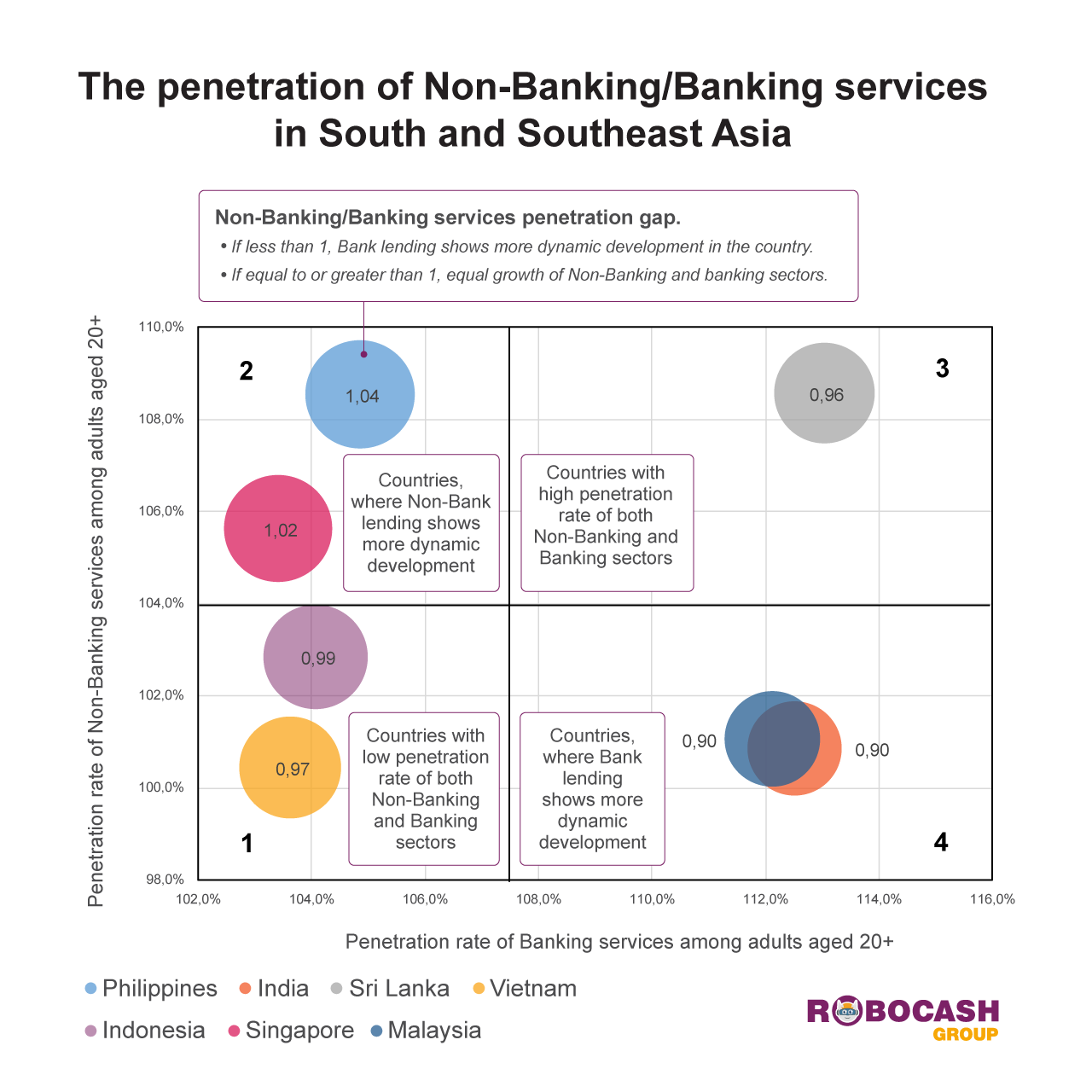

Alternative lending is winning over customers in Asia, bank loans hold strong in Malaysia and India

According to Robocash Group, the Philippines and Singapore feature the fastest growing alternative lending sector. The Philippine bank loans being systematically replaced by the non-bank options. The portfolio of the Philippine non-bank loans in the local currency has increased by 52.3% (+11.1% average YoY). vs. the 42.3% growth of bank loans (+7.3% average YoY). Each year, alternative lending in this region grows on average 4% faster than traditional bank credit.

Robocash Group’s analysts note that the total opposites of the Philippines and Singapore are Malaysia and India: the bank sector in these regions is currently growing faster. Among other contributing factors, this is due to the relative wealth of Malaysians who gravitate towards traditional banking services, as well as national digital initiatives in India within the state banking system.

Vietnam and Indonesia demonstrate low penetration for both the bank and non-bank loans. Still, the average yearly growth of the bank credit market in Vietnam is 3% faster than non-bank lending, with a similar trend in Indonesia – 1% average YoY growth advantage. This may indicate some level of consumer trust towards the banking sector.

The remaining Sri Lanka features a considerable degree of competitiveness. Consumer demand for both credit sectors is growing at a comparable pace, although banking still has a slight advantage.

The period under analysis spans from 2017 through 2021. The data on bank lending is from the database of the analysed countries’ Central Banks. Statista is the source of data for the non-bank sector.