Tata AIA introduces Indian consumers to Vitality, a globally renowned Holistic Wellness program

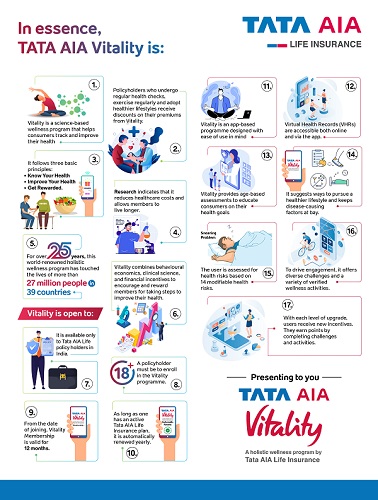

Bangalore, October 19, 2022: Tata AIA Life Insurance (Tata AIA), a leading Life Insurer in India has enhanced its bouquet of life insurance solutions with the launch of a unique wellness program – Tata AIA Vitality -available through its rider packages, Vitality Protect & Vitality Health. With this launch, Tata AIA introduces consumers in India to the globally renowned Vitality platform, that is already available in 40 countries and has benefitted over 30 million individuals over the last 25 years.

Accessible through an easy-to-use mobile app, Tata AIA’s policyholders can use it to avail health check-ups and adopt wellness activities thereby benefiting from a healthier lifestyle. Add to this, consumers get upfront discounts and renewals on their premiums.

Tata AIA Vitality wellness program uses data-driven analytical tools to help consumers take essential measures toward holistic well-being. The mobile app-based interface is divided into three sections:

- Know Your Health – Enables consumers to assess their current health and wellness status

- Improve Your Health – Comprises weekly challenges and activities that consumers can participate in to improve their mental, physical, and social wellbeing

- Get Rewarded – Helps consumers avail discount on premiums upon reaching specific wellness milestones.

Consumers can avail of this holistic wellness platform by purchasing riders available with Tata AIA’s insurance plans spanning term, saving, and, retirement. Riders provide valuable benefits to consumers on payment of small additional premiums along with the base insurance policy. Vitality Protect rider offers comprehensive cover against eventualities such as Accidental Death, Accidental Total & Permanent Disability, apart from giving consumers the option to increase their term insurance cover. The Vitality Health rider covers like Critical illness cover and daily cash in case one is hospitalized for any treatment.

Speaking on the occasion, Venky Iyer, President & Chief Distribution Officer, Tata AIA Life Insurance, said, “At Tata AIA, we are driven by our value of consumer obsession. We continuously evolve in line with the changing needs of consumers and ensure introduction of innovative and consumer centric solutions. Introducing Vitality proposition is a significant step in our transition from a Payor to Partner. We are confident that our initiative will provide the opportunity to our consumers to adopt a healthier lifestyle and give them additional benefits, over and above what they enjoy from our other solutions”

Commenting on the announcement, Barry Swartzberg, CEO of Vitality Global, said, “We are very proud to be associating with TATA AIA to expand the reach of Vitality program and its ability to make millions of people healthier. This is a significant milestone for us as the addition of India to the list of countries linking Vitality to insurance marks the 40th market across the globe.”

On launching the initiative, Neeraj Chopra, Tata AIA Brand Ambassador said, “The importance of being healthy and agile, cannot be emphasized enough. But being healthy is going beyond mere physical fitness and needs to encompass all facets including mental, nutritional, and social fitness. I am proud to be a part of the launch of Tata AIA Vitality in India, as I believe this is a significant step taken in changing how we view wellness. By incentivising good health, Tata AIA Vitality will contribute to transforming the health status of Indians.”

The Vitality Wellness Program was founded over 20 years ago in South Africa, and Vitality is guided by the wealth of data and information at its disposal. Vitality can continuously evolve its model by using its massive data asset – over 50 million life years of behavioral-linked insurance data. Based on sound clinical and scientific research, it uses actuarial savings to incentivize better health choices.

The app-based wellness program delivers age-based assessments to educate consumers about their health goals, ways to pursue a fitter lifestyle, and keep at bay any factors that might put them at risk for disease. Users are assessed for health risks, with a review that involves 14 modifiable health risk factors. The app is specifically designed keeping in mind consumer convenience – users can access their Virtual Health Record (VHR) both online as well as on the app. Scientific evidence shows that members who actively engage in the program live longer and have lower healthcare expenses