Digit Insurance celebrates five-year anniversary, serves 30 million customers since inception

1 st November 2022, Hyderabad: Go Digit General Insurance Limited (Digit), one of India’s fastest-growing insurance players#, completed five years of operations recently. The company, which began its operations in October 2017 with a mission of simplifying insurance, commands a market share of 4.3% in the motor segment.

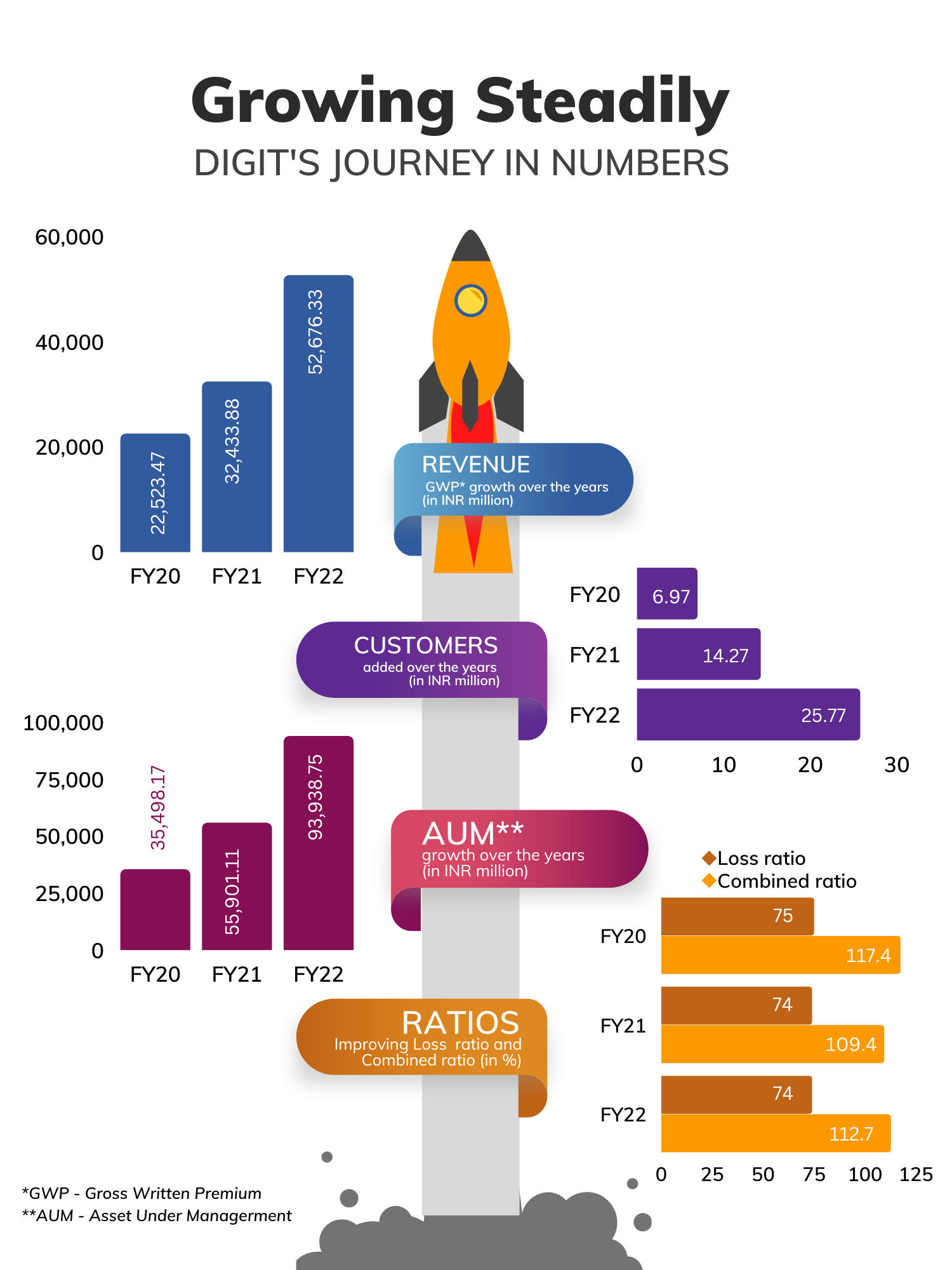

Digit has managed to remain one of the fastest-growing insurers among private general insurers by GDP# for the last three years (FY20 to FY22), establishing a track record of delivering growth. The company posted a revenue$ of Rs 52.68 billion, Rs 32.43 billion, and Rs 22.52 billion in Fiscals 2022, 2021, and 2020, clocking a CAGR of 52.9%. The insurer offers 56 products under motor, health, travel, property, marine, liability, and other insurance lines, and has managed to serve more than 30 million^ people since inception.

Digit had a loss ratio of 74% as of Fiscal 2021 and Fiscal 2022 and also managed to reduce its net expense ratio from 42.4% for Fiscal 2020 to 38.7% for Fiscal 2022, highlighting its improving operational efficiency. The insurer’s combined ratio (a measure of underwriting profitability) has improved from 117.4% in Fiscal 2020 to 112.7% in Fiscal 2022.

“I am excited to see how the Digit story has unfolded in the last five years. The celebration of this milestones truly belongs to our strong team of 2500+ employees and partners who from Day 1 have brought a culture of change and helped the company in achieving these audacious goals. We hope to continue driving our growth by expanding into untapped geographies, acquiring new customers, and growing our product portfolio to meet the evolving needs of the Indian market,” said Jasleen Kohli, MD, and CEO, of Digit Insurance.

Digit has managed to increase its market share from 1.22% in Fiscal 2021 to 2.12% in Fiscal 2022 in terms of total GDP from private and public general insurers. Since inception, it has also managed to capture market share in the motor segment. The company’s motor GDP grew by 53.7% YoY in FY22 compared to the private motor insurance market, which expanded by 9.16%# measured by GDP. It also had net promoter scores of 78% for non-claims and 86.4% for motor claims as of FY22.

The company over the years has managed to differentiate itself by adopting a ‘phy-gital’ distribution model. It has empowered its 32,613-strong partner ecosystem by digitizing offline networks. Digitally enabling the partners through 470 AI-driven microsystems and 1,063 API integrations has helped the company reduce fixed costs significantly and scale rapidly without incurring significant overhead expenses.

The predictive underwriting models utilizing its data bank has helped the company to price risk more accurately, and target markets that are expected to be more profitable. It has also managed to promote a high-quality customer experience by providing relevant, transparent, and customizable coverage through simple and easy-to-understand policy documentation and designing straightforward and paperless processes. The technological integrations have also helped the insurer reduce claims settlement turnaround time (TAT).