Mumbai, July 23rd 2024: ClearTax, India’s leading online tax-filing platform, today announced the launch of its groundbreaking WhatsApp-based Income Tax Return (ITR) filing solution. This groundbreaking service aims to simplify tax filing for over 2 crore of low-income blue-collar individuals in India who often miss out on tax refunds due to complexities in the filing process.

Mumbai, July 23rd 2024: ClearTax, India’s leading online tax-filing platform, today announced the launch of its groundbreaking WhatsApp-based Income Tax Return (ITR) filing solution. This groundbreaking service aims to simplify tax filing for over 2 crore of low-income blue-collar individuals in India who often miss out on tax refunds due to complexities in the filing process.

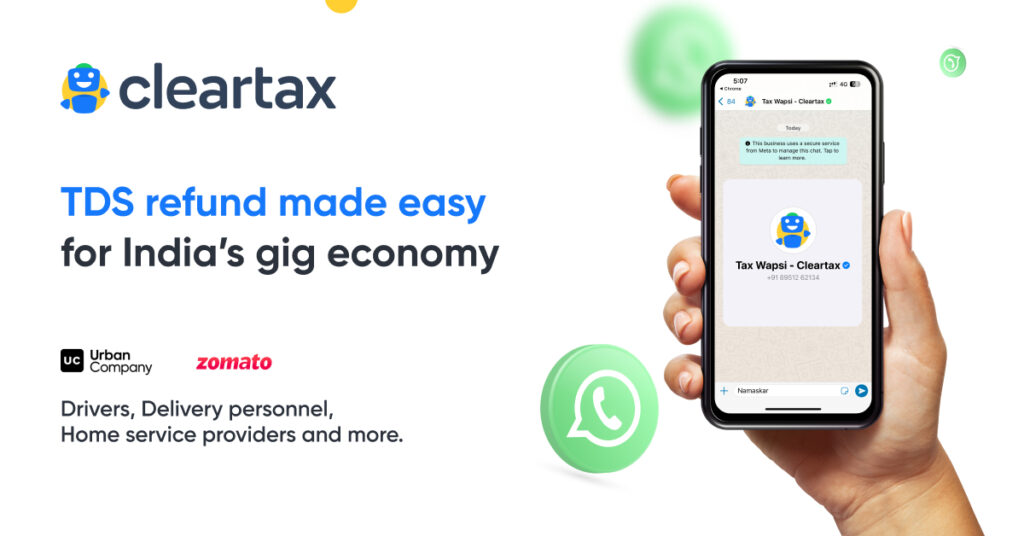

The new solution harnesses the power of artificial intelligence to provide a seamless, chat-based experience directly through WhatsApp, making it accessible to a wide range of users. Currently supporting ITR 1 and ITR 4 forms, the service caters to the needs of most low-income taxpayers. Understanding the diverse linguistic landscape of India, ClearTax offers the service in 10 languages including English, Hindi, and Kannada, ensuring broader reach and usability. The platform also features a secure payment integration system, allowing users to complete the entire process, from filing to payment, within the familiar WhatsApp interface. Users can easily gather and submit required information through images, audio, and text, streamlining the data collection process. The AI bot is powered by advanced language models, provides instantaneous help, guiding users through every step of the process. Moreover, the AI-powered system automatically selects the most beneficial tax regime for each user, maximizing potential savings.

The service is particularly beneficial for blue-collar workers, including drivers, delivery executives, home service providers, and many more. By leveraging the familiarity and widespread use of WhatsApp, ClearTax is making tax filing more accessible and user-friendly than ever.

Archit Gupta, founder, CEO of ClearTax said, “Our WhatsApp solution addresses a critical gap in tax compliance that has long plagued India’s workforce. We’re not just simplifying tax filing, we’re democratizing financial empowerment. We are making Bharat Aatmanirbhar and financially self reliant. By bringing this service to WhatsApp, we’re meeting people where they are, eliminating technological barriers, and ensuring that millions of hardworking Indians can claim their rightful refunds with just a few taps on their phones. This isn’t just about convenience – it’s about financial justice and inclusion. We’re proud to be at the forefront of this transformative approach to tax filing, one that has the potential to put money back into the pockets of those who need it most.”

ClearTax is running financial education campaigns to enlighten potential filers about the benefits and importance of filing their ITR. We are also partnering with employers to streamline the process further, offering benefits such as reduced administrative burden and enhanced employee satisfaction.

More Stories

Master’s Transportation Wins Economic Development Impact Award

KANSAS CITY, Mo. Jan 26 - Master's Transportation™, a leading provider of commercial buses and vans, receives the Economic Development Impact...

inDrive Introduces inDrive Ads as a New Global Advertising Platform in Egypt

inDrive, the global mobility and urban services platform, has launched inDrive Ads, a new global advertising platform designed to support...

Indian Bank Celebrates 77th Republic Day with CSR Support for Women and Children

Chennai, Jan 26: Indian Bank marked the nation's 77th Republic Day with great enthusiasm at its Corporate Office and Head...

NMDC Celebrates 77th Republic Day Across India, Reaffirming Commitment to Responsible Mining and Nation-Building

Hyderabad, Jan 26: India’s largest iron ore producer and Responsible Miner NMDC, marked the 77th Republic Day with patriotic fervour and...

Canara Bank Celebrates the 77th Republic Day of India

Bengaluru, 26th January 2026: On India's 77th Republic Day, Canara Bank MD & CEO Sri Hardeep Singh Ahluwalia extended Republic...

News Announcement_Union Budget 2026: Zee Business Goes ‘Bold and Bullish’ with Minute-by-Minute Analysis

Zee Business, one of India’s leading business news channels, will present comprehensive coverage of Union Budget 2026 under the theme...