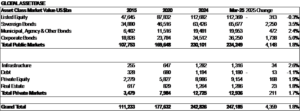

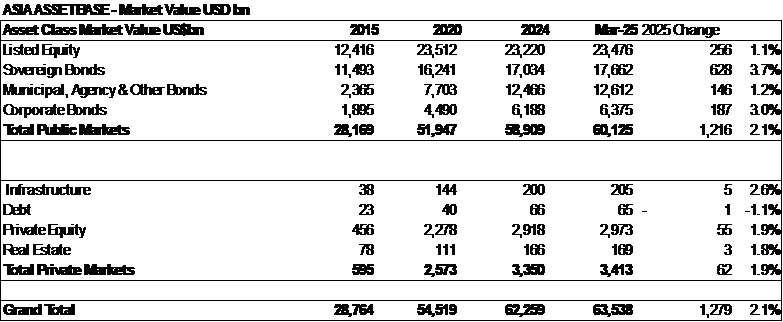

March 13, 2025: Asia’s publicly listed and privately held asset base have grown 2.1% since the turn of the year , reaching a record $63.5 trillion, according to the latest Global Asset Monitor from Ocorian, a market leader in asset servicing for private markets and corporate and fiduciary administration.

The $1.3 trillion increase mainly reflected larger government bond markets, driven principally by issuance of new debt. Nevertheless, listed equity markets swelled $256bn, or 1.1%. Hong Kong and China drove the value of Asian listed companies higher, adding $870 between them, but most other markets in region saw company values shrink. Despite the strong start to 2025, between them Hong Kong and Chinese companies still languish $1.3 trillion below their level 5 years ago (December 2020). All this left the combined value of Asia’s public equity and bond markets up 2.1%.

Asia’s private assets under management rose an estimated 1.9%, but the complexion was different. They added $62bn thanks mainly to higher private equity valuations. Ocorian’s modelling of private asset values saw them reach $3.4 trillion at the end of February, still below the $3.6 trillion peak reached in 2021.

The rest of the world saw total assets rise 1.7% or $3.1 trillion year-to-date, mainly reflecting bond issuance and stronger currencies. A sharp drop in US share prices in March, especially among the Magnificent 7, meant the rest of the world’s equity values were lower by $569 bn year-to-date. The rest of the world’s private assets rose 1.6%.

Despite their more recent slowdown, private markets have grown much faster in the last fifteen years in Asia than in the rest of the world. Ocorian’s modelling of Preqin data shows that Asia’s private asset funds under management were 21 times larger than in 2009 at the end of February. In the rest of the world, private assets are six times larger.

This superior long-term growth rate reflects the fact that private assets have come from a much smaller base. In 2009, private assets under management were less than 1% of the $19.2 trillion total value of our eight asset classes in Asia, compared to just under 3% of the $53.7 trillion for the rest of the world. Now, Asia’s private funds are 5.4% of its total $63.5 trillion total asset base, a slightly larger share than the 5.2% for the rest of the world.

Robin Harris, Head of APAC at Ocorian said: “The Asian tiger may not yet be roaring back, but it’s definitely stirring. Asia’s private markets have lagged behind the wider world in recent years owing to the economic stagnation in China. As the largest private equity market in Asia, the lack of investor interest in China therefore weighs heavily on the regional totals. Keen interest in Japan, India and South Korea has not yet offset this effect.

“Conditions are improving, however. High savings and a significant increase in the number and net worth of the wealthy Asian individuals and families who are typically most interested in private investment funds mean solid foundations for private assets in the region. The capital is ready for deployment – dry powder in Asia currently totals close to $572bn in private equity alone, with another $150bn across infrastructure, property and private debt funds.

“Across Asia, private markets are proving critical in transforming the way businesses grow. Public markets have long provided a structured path for companies to raise capital and investors to earn returns, but their reach is far more limited than their size suggests. And the vast majority of companies are still privately owned – around 90% in the US for example. Investors and businesses alike are seeking alternative paths to growth, and private capital is increasingly the bridge between opportunity and execution. The global investment landscape is shifting rapidly – the dramatic growth in private assets reflects both a flow of capital to the sector and superior performance over the long term.”