New Delhi, April 13, 2023: HDFC Asset Management Co. Ltd., investment manager to HDFC Mutual Fund (HDFC MF), one of India’s leading mutual fund houses,has announced the launch of three schemes – HDFC S&P BSE 500 Index Fund, HDFC NIFTY Midcap 150 Index Fund& HDFC NIFTY Smallcap250 Index Fund. The launch of these schemes will expand the site of HDFC MF Index Solutions, and allow investors to participate in the India growth story in a diversified manner.

The respective indices offer diversified exposure to large, mid and smallcap segments, but with lower volatility than the vast majority of their underlying constituents. Thus, the Index Funds tracking these respective indices offer a simple and efficient way to gain exposure to large, mid and small-caps through a single instrument. Moreover, winners among large-cap, midcap and smallcap indices change from year to year, and hence investors can get exposure to all 3 market cap segments through these Index Funds.

The captioned NFOcommenced on April 6, 2023 and will close on April 18, 2023. Commenting on the launch, Navneet Munot, Managing Director and Chief Executive Officer, HDFC Asset Management Co. Ltd. said, “With our ‘Investor first’ approach in mind, HDFC Mutual Fund continues to offer varied investment solutions to the investors. We are one of the pioneers in the passive funds space with over 20-years of experience. We are further expanding our product bouquet with the launch of these 3 new Index Funds. These funds will allow investors to participate in the India growth story while diversifying across market caps.”

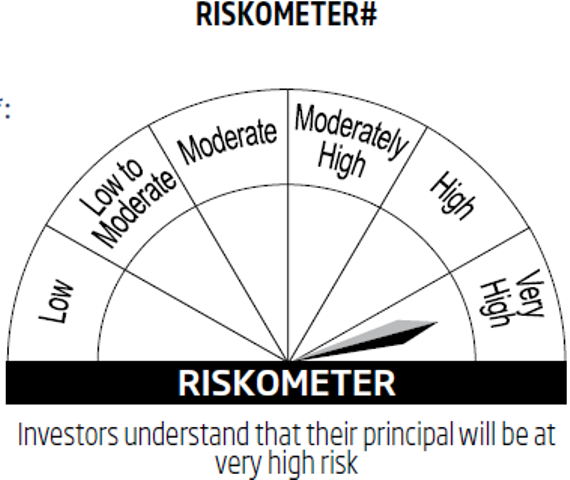

| Name of Scheme / Investment Plan | This product is suitable for investors who are seeking* | Risk-o-meter# |

| HDFC S&P BSE 500 Index Fund, HDFC NIFTY Midcap 150 Index Fundand

HDFC NIFTY Smallcap 250 Index Fund

|

– Returns that are commensurate (before fees andexpenses) with the performance of the underlyingindex [S&P BSE 500 Index (TRI),NIFTY Midcap 150 Index(TRI), NIFTY Smallcap 250 Index (TRI) respectively] overlong term, subject to tracking error.

– Investment in securities covered by the underlying Index |

|

| *Investors should consult their financial advisers, if in doubt about whether the product is suitable for them. #The product labeling assigned during the NFO is based on internal assessment of the scheme characteristics or model portfolio and the same may vary post NFO when the actual investments are made. For latest riskometer, investors may refer to the Monthly Portfolios disclosed on the website of the Fund viz. www.hdfcfund.com | ||

More Stories

MGM Group of Hospitals Conducts BLS Training to Raise Cardiac Emergency Awareness

Chennai, Jan 27: In a landmark public health and community preparedness initiative, MGM Healthcare rolled out a city wide Basic Life Support (BLS) training programme...

Pre-Budget Quote: Vedaanta Senior Living Shares Expectations Ahead of the Union Budget

"India is entering a longevity era where older adults are reshaping how we understand ageing. In the next decade, seniors...

Pre-Budget Expectations: Experts from India’s Leading Stock Broking, Personal Finance, Startup Advisory and Legal Firms Share Insights

Arpit Jain, Joint MD, Arihant Capital Markets LtdThe 2026-27 Budget needs to clearly pivot towards capex-led growth, which was relatively absent in...

Accelerating progress in 2026 towards a streamlined sustainability reporting system

Quarterly Standards Update: consultations on labor and economic impacts, plus Biodiversity and Mining Standards take effectAmsterdam, Jan 27 – With...

Master’s Transportation Wins Economic Development Impact Award

KANSAS CITY, Mo. Jan 26 - Master's Transportation™, a leading provider of commercial buses and vans, receives the Economic Development Impact...

inDrive Introduces inDrive Ads as a New Global Advertising Platform in Egypt

inDrive, the global mobility and urban services platform, has launched inDrive Ads, a new global advertising platform designed to support...